Market Update: Bank of Canada Increases Key Rate

In January the Bank of Canada announced they were conditionally pausing interest rate increases to see if the previous increases got inflation under control. The data showed just how resilient the Canadian economy with inflation decreases for 9 consecutive months. However, this past month saw an unexpected increase in the inflation rate.

On Wednesday the Bank of Canada announced a 25 basis point increase, bringing the key interest rate to 4.75%. This is the highest the rate has been since 2001. While a few experts and economists had a feeling we could see this increase, the consensus thoughts were the increase would not come until later in the year. Now, it is thought that even more rate increases are coming down the pipeline, with some thinking we could hit the 5.25% mark or even beyond.

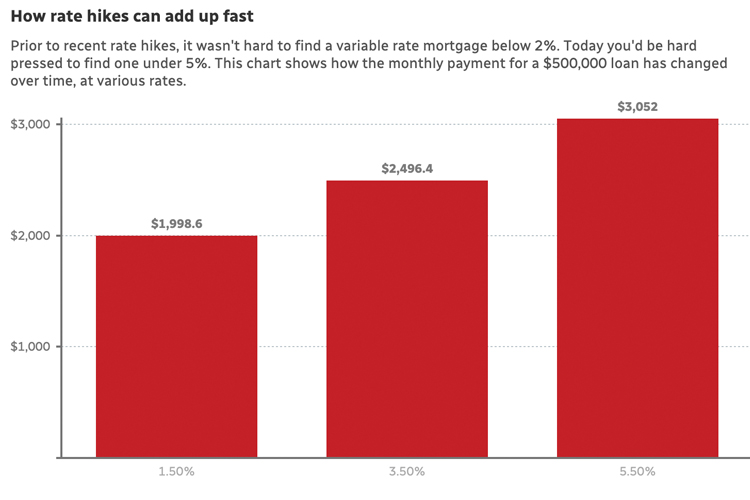

So what does this mean for the Windsor real estate market and those looking for houses for sale in Windsor? Well, within hours of the announcement Canada's major banks all matched the Bank of Canada’s increase, raising their prime lending rates to 6.95%. This move from the Bank of Canada is going to make variable rate mortgages even more expensive for those holding one, many of whom have already seen their payments skyrocket this year. Based on the previously announced rate hikes, holders are paying over $1,000 more monthly on a $500,000 mortgage, that is before this most recent increase.

Courtesy: CBC; https://www.cbc.ca/news/business/bank-of-canada-rate-decision-1.6868206

Courtesy: CBC; https://www.cbc.ca/news/business/bank-of-canada-rate-decision-1.6868206

Here at Jump Realty our agents will give you honest advice on what course of action is best for you in their professional opinion and will always put taking care of your best interests first! With offices in Windsor, Tecumseh, Kingsville, LaSalle, Harrow, Chatham, and Leamington, no matter where you are, a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!