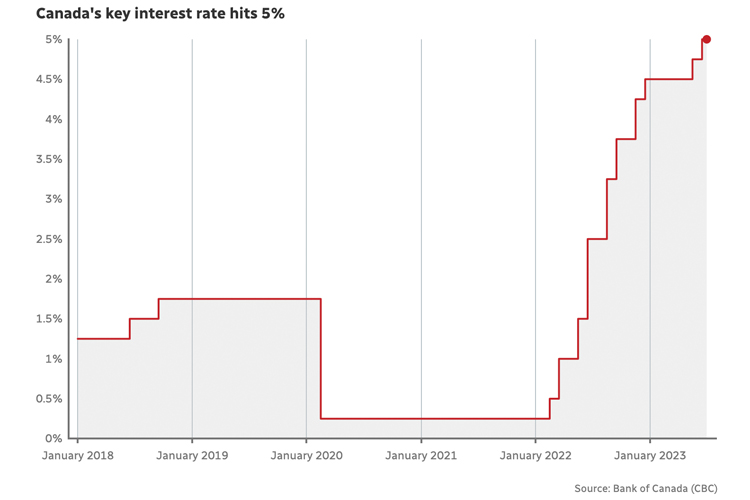

Market Update: Bank of Canada Increases Key Rate Again

After this winter's conditional pause, the Bank of Canada followed up their June rate increase with another increase this week. With an overheated economy being fuelled by an additional 60,000 in the Canadian workforce according to a Stats Canada report, the bank decided more action was necessary.

On Wednesday the Bank of Canada announced an increase of 25 basis points, bringing the key interest rate to 5%. This is the first time the ley rate has hit 5% since April of 2001. In its release the bank noted

"Global inflation is easing, with lower energy prices and a decline in goods price inflation. However, robust demand and tight labour markets are causing persistent inflationary pressures in services."

During the news conference, Bank of Canada governor Tiff Macklem said the bank expects inflation to ease but for the bank to hit its goal of 2%, it may not occur until the middle of 2025.

So what does this mean for the Windsor real estate market and those looking for houses for sale in Windsor? Well, once again within hours of the announcement Canada's major banks all matched the Bank of Canada’s increase. This will again have an effect on those with a variable rate mortgage and those due for renewal in the short-term. While the true dollar cost increases will vary from mortgage to mortgage, the general consensus is that monthly costs will increase on average $100 per month, $1200 a year.

Here at Jump Realty our agents will give you honest advice on what course of action is best for you in their professional opinion and will always put taking care of your best interests first! With offices in Windsor, Tecumseh, Kingsville, LaSalle, Harrow, Chatham, and Leamington, no matter where you are, a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!