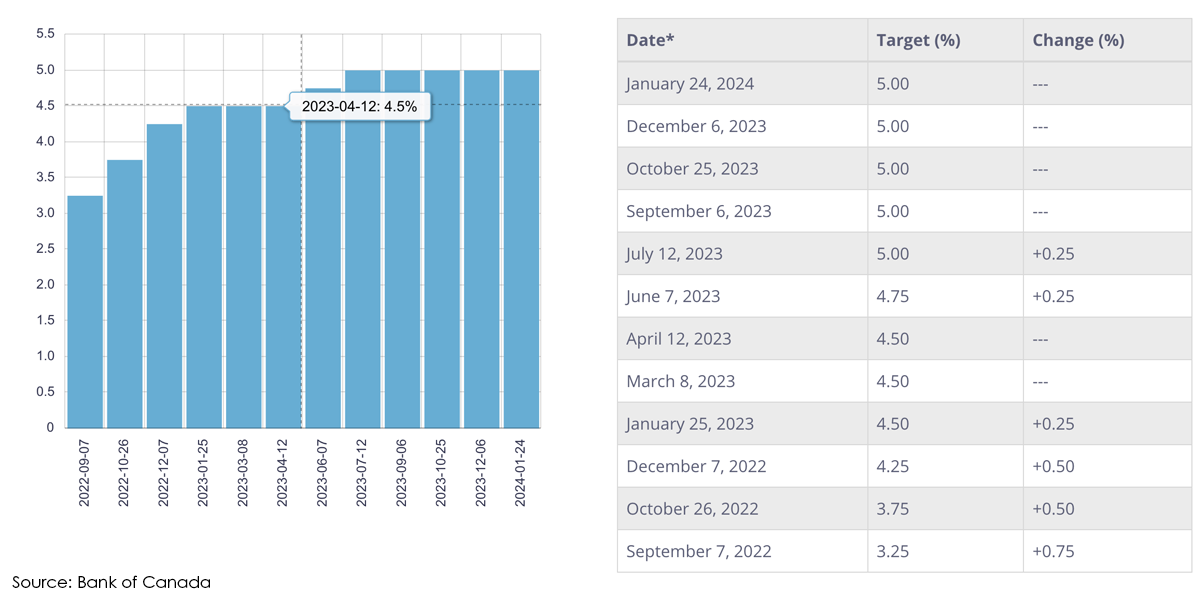

The Bank of Canada announced today that they are holding their key rate at 5%. This follows their December decision to hold rates at 5% after issuing 10 increases between early 2022 and July 2023. This is yet another signal that rate increases are now done, with some experts expecting rates to begin to decrease in the second half of 2024.

In their prepared announcement, the Bank said to not expect rate decreases any time soon, "inflation is still too high" (Heydari, 2024) Tiff Macklem, the Governor of the Bank of Canada said he does not expect anymore conversartions about increases, "I expect future discussions will be about how long we maintain the policy rate at five per cent." (Heydari, 2024)

For buyers looking for homes for sale in the Windsor real estate market, this yet another sign of stability and will continue to help buyers get into the market as spring approaches and supply starts to increase as well. This news also provides another sense of relief for variable mortgage holders and those up for renewal.

Here at Jump Realty our agents will give you honest advice on what course of action is best for you in their professional opinion and will always put taking care of your best interests first! With offices in Windsor, Tecumseh, Kingsville, LaSalle, Harrow, Chatham, and Leamington, no matter where you are, a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!

Quotes Source: Heydari, A. (2024, January 24). No change on interest rate as bank of Canada sticks to 5% | CBC News. CBCnews. https://www.cbc.ca/news/business/bank-of-canada-interest-rate-january-1.7093055