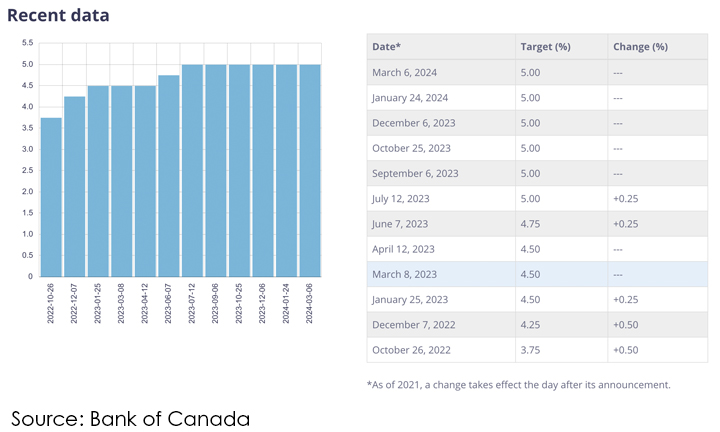

The Bank of Canada announced this morning that they once again holding their key interest rate steady at 5% following their decision in January to hold rates then. This marks the 6th consecutive rate hold after issuing 10 rate increases between early 2022 and July 2023. The Bank of Canada continues to illustrate that rate increases are now done, however they are not ready to start lowering rates yet. The expectations of economists is that any potenital decreases will come in the last 2 quarters of 2024.

In their prepared statement Governor of the Bank of Canada Tiff Macklem said this, "In the six weeks since our January decision, there have been no big surprises. Economic growth has remained weak, and inflation has eased further as higher interest rates restrain demand and relieve price pressures. But with inflation still close to 3% and underlying inflationary pressures persisting, the assessment of Governing Council is that we need to give higher rates more time to do their work." (Bank of Canada, 2024)

For buyers looking for houses for sale in the Windsor real estate market, this stability will continue to help them feel secure in their searches and mortgage pre-approvals. For current home owners with a variable mortgage holders or those up for renewal, this news priovides some security and relief as well.

Here at Jump Realty our agents will give you honest advice on what course of action is best for you in their professional opinion and will always put taking care of your best interests first! With offices in Windsor, Tecumseh, Kingsville, LaSalle, Harrow, Chatham, and Leamington, no matter where you are, a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!

Quotes Courtesy: Bank of Canada; https://www.bankofcanada.ca/2024/03/opening-statement-2024-03-06/