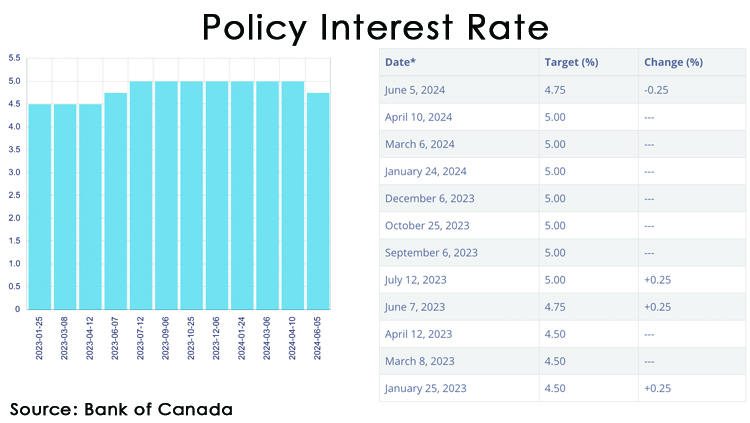

After 7 consecutive rate holds, the Bank of Canada has reduced their key rate by 25 basis points, this brings the policy rate to 4.75%. This marks the first rate cut since the country's central bank began increasing rates in early 2022 in response to inflation concerns, increases that occurred on ten occasions between then and July 2023.

After their March decision to hold rates, economists had mixed opinions on whether the Bank of Canada would hold rates once again or decrease the rate. The expectation was we would see decreases in Q3 and Q4 of 2024 if the key indicators the bank were monitoring continued to trend in the right direction. Today the bank decided these indicators had provided enough information and decided to decrease rates.

In his prepared opening remarks, Governor of the Bank of Canada Tiff Macklem said this. "We’ve come a long way in the fight against inflation. And our confidence that inflation will continue to move closer to the 2% target has increased over recent months. The considerable progress we’ve made to restore price stability is welcome news for Canadians. Since our Monetary Policy Report in April, underlying inflation has continued to ease and economic growth has resumed. With the economy in excess supply, there is room for growth even as inflation continues to recede." (Bank of Canada, 2024)

He also discussed where the Bank of Canada sees rates heading in the future. "If inflation continues to ease, and our confidence that inflation is headed sustainably to the 2% target continues to increase, it is reasonable to expect further cuts to our policy interest rate. But we are taking our interest rate decisions one meeting at a time. We don’t want monetary policy to be more restrictive than it needs to be to get inflation back to target. But if we lower our policy interest rate too quickly, we could jeopardize the progress we’ve made. Further progress in bringing down inflation is likely to be uneven and risks remain. Inflation could be higher if global tensions escalate, if house prices in Canada rise faster than expected, or if wage growth remains high relative to productivity." (Bank of Canada, 2024)

What does this rate decrease mean for Windsor-Essex real estate? It could help summer buyers looking for houses for sale in the Windsor real estate market purchase with more confidence as well as come as some relief to those with or looking at variable mortgages.

The Bank of Canada's next rate announcement is scheduled for July 24, 2024.

Graph Courtesy: Bank of Canada; https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/

Quotes Courtesy: Bank of Canada; https://www.bankofcanada.ca/2024/06/opening-statement-2024-06-05/

Here at Jump Realty our agents will give you honest advice on what course of action is best for you in their professional opinion and will always put taking care of your best interests first! With offices in Windsor, Tecumseh, Kingsville, LaSalle, Harrow, Chatham, and Leamington, no matter where you are, a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!