It is back-to-back rate cuts from the Bank of Canada. On the heels of cutting their key rate by 25 points in June, Canada's main bank has reduce rates again by another 25 basis points to 4.5% in todays announcement. With CPI inflation decreasing to 2.7% in June after an increase in May, another rate cut was a possibility from the bank.

In prepared opening remarks, Tiff Macklem the Governor of the Bank of Canada, laid out three key reasons for their second consecutive rate cut. "First, monetary policy is working to ease broad price pressures. Second, with the economy in excess supply and slack in the labour market, the economy has more room to grow without creating inflationary pressures. Third, as inflation gets closer to the 2% target, the risk that inflation comes in higher than expected has to be increasingly balanced against the risk that the economy and inflation could be weaker than expected." (Bank of Canada, 2024)

Could there be more rate cuts in the future? Macklem was optimistic there will be. "Looking ahead, we expect inflation to moderate further, though progress over the next year will likely be uneven. This forecast reflects the opposing forces affecting inflation. The overall weakness in the economy is pulling inflation down. At the same time, price pressures in shelter and some other services are holding inflation up. We are increasingly confident that the ingredients to bring inflation back to target are in place. But the push-pull of these opposing forces means the decline in inflation will likely be gradual, and there could be setbacks along the way. If inflation continues to ease broadly in line with our forecast, it is reasonable to expect further cuts in our policy interest rate. The timing will depend on how we see these opposing forces playing out. In other words, we will be taking our monetary policy decisions one at a time." (Bank of Canada, 2024)

What does this rate decrease mean for Windsor-Essex real estate? It could help buyers looking for Windsor homes for sale find that right home and if you are in due to renew your mortgeage soon, this additional rate cut will be helpful during renewal.

The Bank of Canada's next rate announcement is scheduled for September 4, 2024.

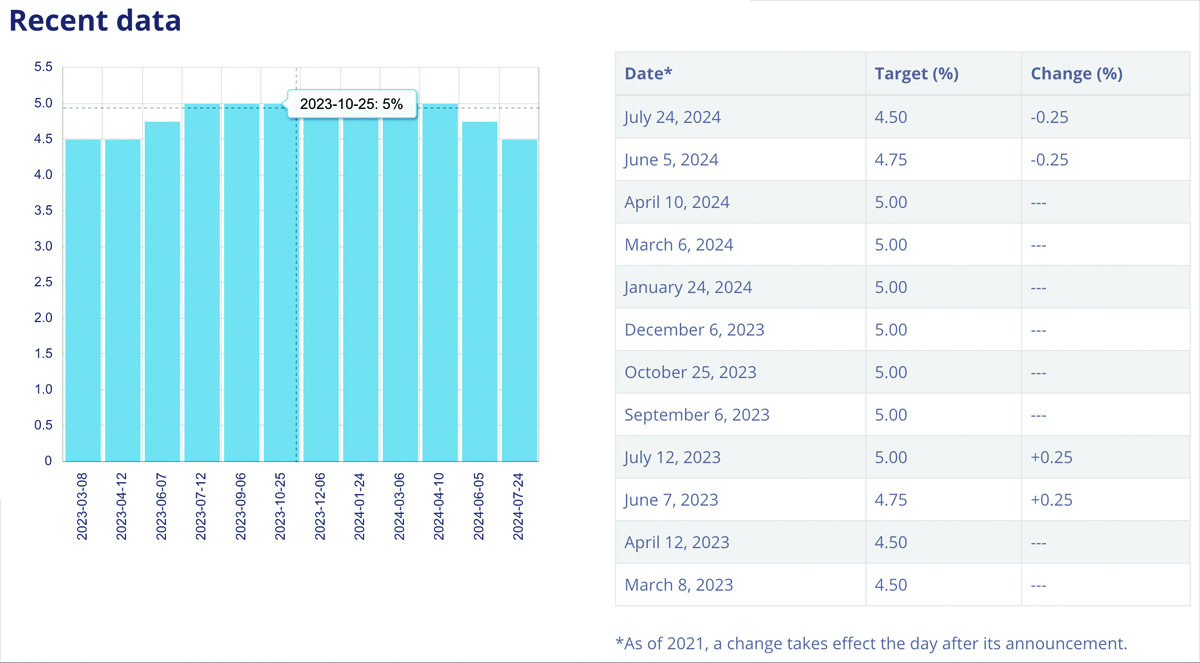

Graph Courtesy: Bank of Canada; https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/

Graph Courtesy: Bank of Canada; https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/

Quotes Courtesy: Bank of Canada; https://www.bankofcanada.ca/2024/07/opening-statement-2024-07-24/

Here at Jump Realty our agents will give you honest advice on what course of action is best for you in their professional opinion and will always put taking care of your best interests first! With offices in Windsor, Tecumseh, Kingsville, LaSalle, Harrow, Chatham, and Leamington, no matter where you are, a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!