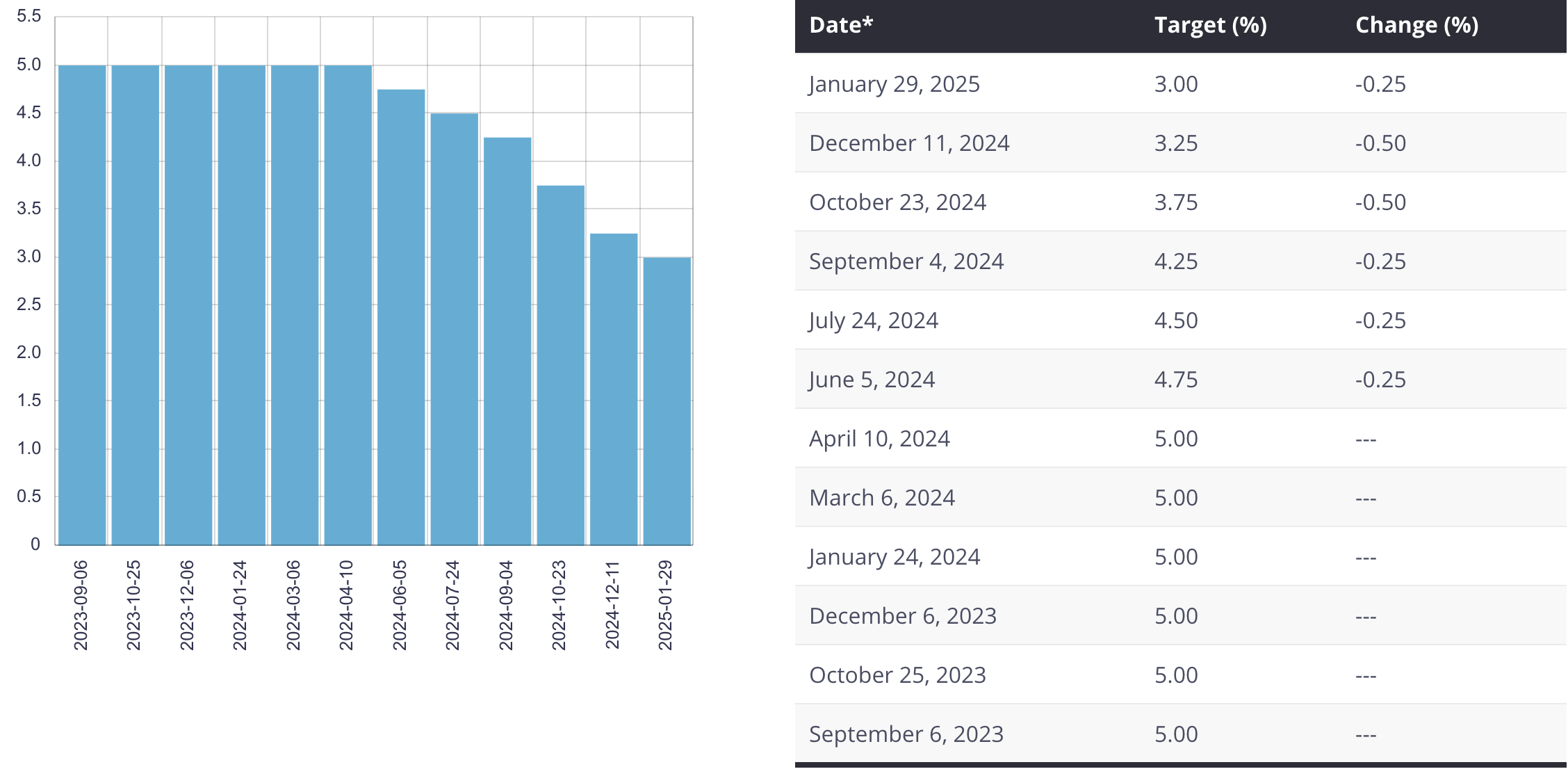

Make it six in a row. After five consecutive rate cuts to end 2024, the Bank of Canada has dropped their key rate once again to begin 2025. In their announcement today, Canada's central bank reduced the rate by 25 basis points bringing their policy interest rate to 3.00%.

In his prepared statement this morning Tiff Macklem, the Governor of the Bank of Canada, discussed three main points that drove the decision." First, inflation has been close to the 2% target since last summer. Monetary policy has worked to restore price stability. Second, lower interest rates are boosting household spending, and economic activity is picking up. Third, the potential for a trade conflict triggered by new US tariffs on Canadian exports is a major uncertainty. This could be very disruptive to the Canadian economy and is clouding the economic outlook." (Bank of Canada, 2025)

The third point, the looming tariff threats from the United States were addressed further by Macklem. "US trade policy is a major source of uncertainty. There are many possible scenarios. We don’t know what new tariffs will be imposed, when or how long they will last. We don’t know the scope of retaliatory measures or what fiscal supports will be provided. And even when we know more about what is going to happen, it will still be difficult to be precise about the economic impacts because we have little experience with tariffs of the magnitude being proposed." (Bank of Canada, 2025)

He continued with, "Monetary policy cannot offset this. What we can do is help the economy adjust. With inflation back around the 2% target, we are better positioned to be a source of economic stability. However, with a single instrument—our policy interest rate—we can’t lean against weaker output and higher inflation at the same time. As we consider our monetary policy response, we will need to carefully assess the downward pressure on inflation from weakness in the economy, and weigh that against the upward pressure on inflation from higher input prices and supply chain disruptions." (Bank of Canada, 2025)

The Bank of Canada's next rate announcement is scheduled for March 12, 2025.

Graph Courtesy: Bank of Canada; https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/

Quotes Courtesy: Bank of Canada; https://www.bankofcanada.ca/2025/01/opening-statement-2025-01-29/

Here at Jump Realty our agents will give you honest advice on what course of action is best for you in their professional opinion and will always put taking care of your best interests first! With offices in Windsor, Tecumseh, Kingsville, LaSalle, Harrow, Chatham, and Leamington, no matter where you are, a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!