Mortgage Guide: What Does Mortgage Term Mean

We’ve talked recently about a variety of topics revolving around mortgages. If you’re active or thinking about getting into the Windsor real estate market your Windsor REALTOR® has most likely given you some instructions prior to starting your search for houses for sale in Windsor and what Windsor homes you’d like to view. One such thing is talking to a mortgage lender to get a pre-approval, a topic we’ve discussed. This is the number your agent will use to start your homes for sale in Windsor search. It’s important to understand the bones of your mortgage contract at minimum. We’ve discussed some different aspects before, but in this post we’ll look at a phrase used often and help you understand what it means, your mortgage term.

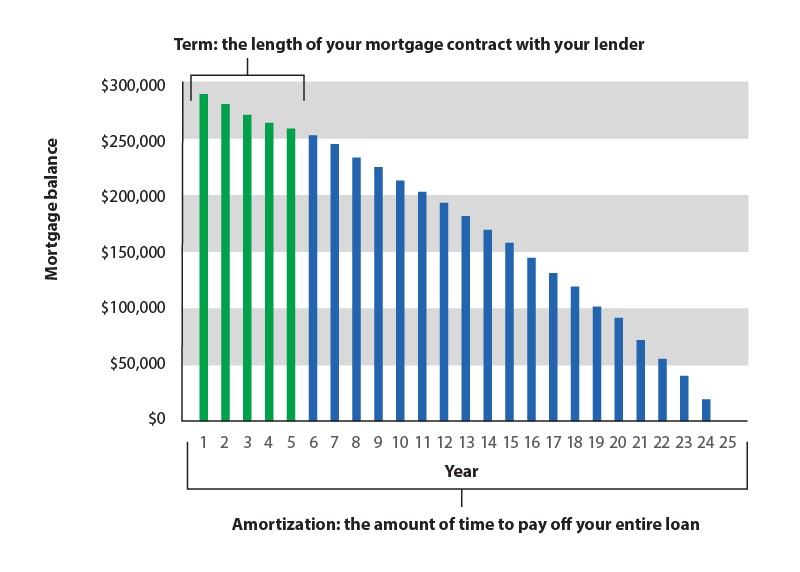

First let's talk about what a mortgage term is. Simply, it is the length of time your mortgage contract is in effect. Your mortgage contract outlines the details of your agreement with the lender including your interest rate. Terms can range in length from months to five years to sometimes even longer. At the end of each term, you must renew your mortgage and most people require multiple terms to pay their mortgage back in full.

There are three types of mortgage terms. Shorter-term mortgages are typically 5 years or less, remember the shorter the term the sooner you must renew. Shorter-term mortgages have either fixed or variable interest rates available. Longer-term mortgages have a term greater than 5 years. These only have a fixed interest rate and that rate is locked in for a longer period of time. Finally there is the convertible term mortgage. This is when a shorter-term mortgage is converted or extended into a longer-term mortgage and when that occurs a new interest rate typically applies.

One thing to remember is that your term sets your interest rate. Lenders normally offer different interest rates for different mortgage term lengths. The interest rates offered by lenders typically increase as the term length increases, though that is not always the case. Finally, that rate is what will directly affect what your payments are. So choose what works best for you! To learn more about mortgage terms, CLICK HERE.

(Courtesy Financial Consumer Agency of Canada)

Here at Jump Realty our agents will give you honest advice on what course of action is best for you in their professional opinion and will always put taking care of your best interests first! With offices in Windsor, Tecumseh, Kingsville, and Chatham, no matter where you are, a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!