Mortgage Guide: Understanding Your Amortization Period

In a recent post we discussed mortgage terms. Remember, if you’re active or thinking about getting into the Windsor real estate market, your Windsor REALTOR® has already explained the importance of getting your mortgage pre-approval prior to starting your search for houses for sale in Windsor, Then you can start viewing Windsor homes as you start your homes for sale in Windsor search. If you recall, your mortgage term is the length of time your mortgage contract is in effect. For more information on mortgage terms, the different types, and what they mean, check out that post HERE.

In this post we are going to be discussing the other part of your mortgage. Along with your mortgage term, you’ll have your mortgage amortization period. The amortization period is the length of time it takes to pay off your mortgage in full. It is an estimate that is based on the interest rate for your current term. Important note, if your down payment is less than 20% of the price of your home, the longest amortization you’re allowed is 25 years.

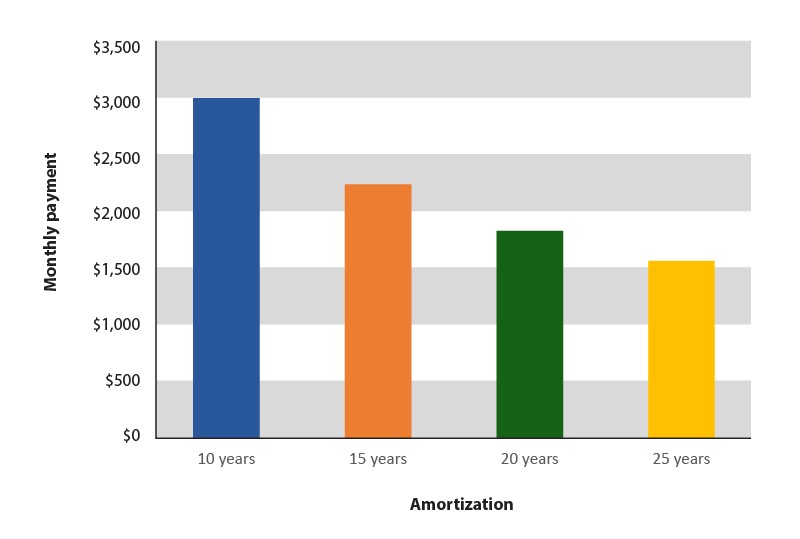

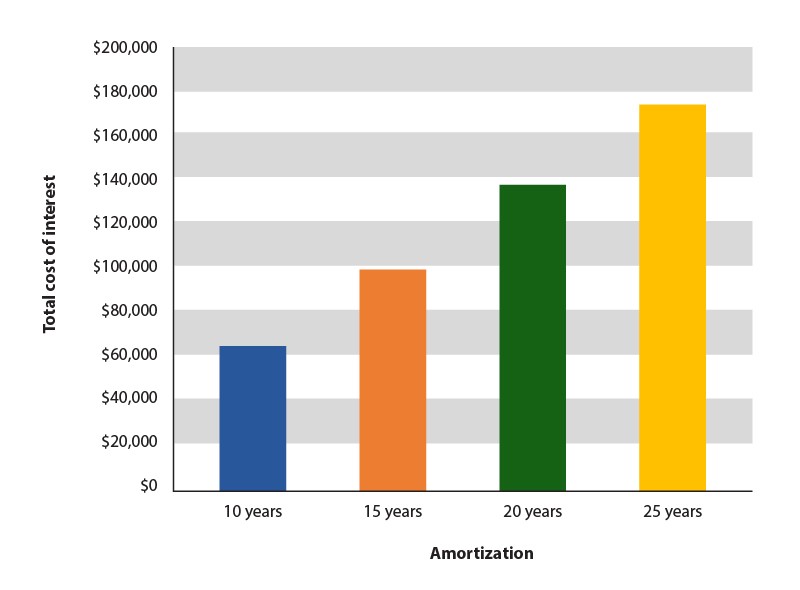

Remember, just like the term affects your cost, so does your amortization period. In general, a longer amortization period will result in lower payments. While your payments are lower, keep in mind that if you take longer to pay off your mortgage, you’ll also end up paying more in interest.

To illustrate this, take a look at the two figures below. Figure 1 shows how your monthly payments decrease as your amortization period increases. Figure 2 shows how as your amortization period increases, as does your mortgage payments.

Figure 1: Amortization Period in Relation to Monthly Payments

(Courtesy Financial Consumer Agency of Canada)

(Courtesy Financial Consumer Agency of Canada)

-----------------------------------------------------------------------------------------------------------------

Figure 2: Amortization Period in Relation to Interest Incurred

(Courtesy Financial Consumer Agency of Canada)

It is important to understand this relationship when discussing your mortgage contract with potential lenders. For more information on amortization and how it ties in with the mortgage term, CLICK HERE.

Here at Jump Realty our agents will give you honest advice on what course of action is best for you in their professional opinion and will always put taking care of your best interests first! With offices in Windsor, Tecumseh, Kingsville, and Chatham, no matter where you are, a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!