Your Credit Score: How To Improve It

If you’re thinking about buying a home for the first time, you may have people telling you to make sure you’re taking good care of your credit score. This is good advice, your credit score is one of many factors that go into determining your mortgage. A better credit score means a better chance you have of receiving a better mortgage. So how can you go about building a better credit score? The Canadian Government has some tips to help you!

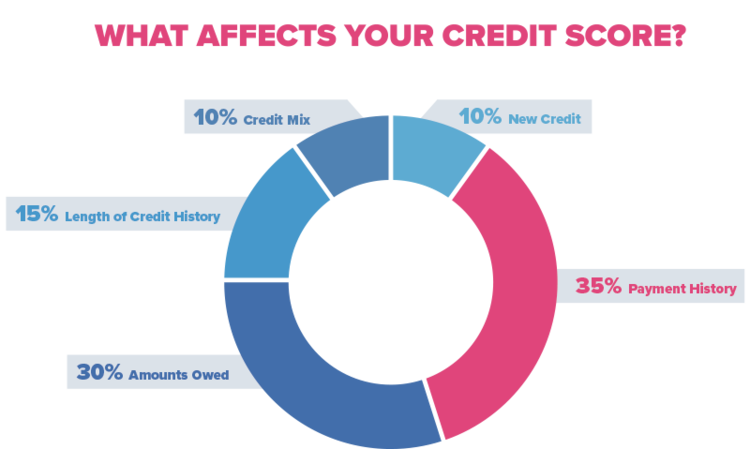

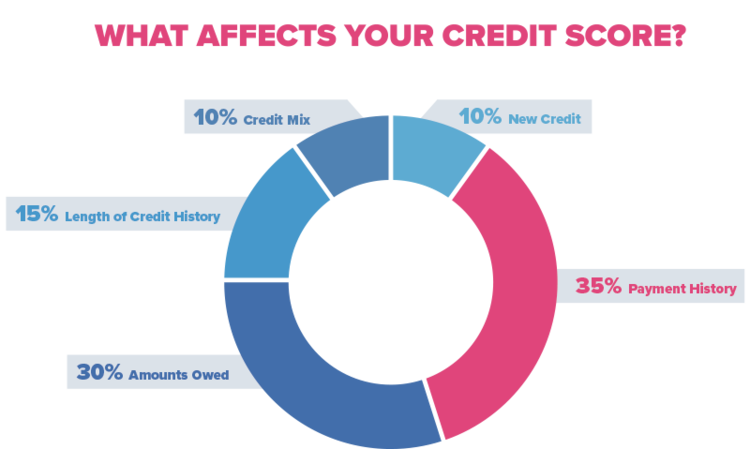

- Monitor Your Payment History

- This is the most important factor in your credit score

- Always making your payments on time, making at least the minimum payment if you can’t pay the full amount that you owe, contacting the lender right away if you think you'll have trouble paying a bill and not skipping a payment even if a bill is in dispute are some of the easiest ways to improve your payment history and credit score.

- Use Credit Wisely

- Don’t go over your credit limit. If you have a credit card with a $5,000 limit, try not to go over that limit. Borrowing more than the authorized limit on a credit card can lower your credit score.

- Try to use no more than 35% of your available credit. It’s better to have a higher credit limit and use less of it each month.

- If you use a lot of your available credit, lenders see you as a greater risk. This is true even if you pay your balance in full by the due date.

- Increase the Length of your Credit History

- The longer you have a credit account open and in use, the better it is for your score. Your credit score may be lower if you have credit accounts that are relatively new.

- Don’t forget, if you transfer an older account to a new account, the new account is considered new credit.

- Consider keeping an older account open even if you don't need it. Use it from time to time to keep it active.

- Limit your Number of Credit Applications or Checks

- It’s normal and expected that you'll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, it’s recorded as an inquiry. Inquiries are also known as credit checks.

- If there are too many credit checks in your credit report, lenders may think that you’re either urgently seeking credit or trying to live beyond your means.

- Use Different Types of Credit

- Your score may be lower if you only have one type of credit product, such as a credit card.

- It's better to have a mix of different types of credit, such as a credit card, a car loan, or a line of credit.

- A mix of credit products may improve your credit score. Just make sure you can pay back any money you borrow, you could end up hurting your score by taking on too much debt.

Here at Jump Realty, all of our agents put their customers' needs at the forefront of their work. They’ll give you honest advice on what course of action is best for you in their professional opinion. Whether you are buying or selling our agents are looking out for you first. All of our agents pride themselves on putting their clients' needs above all else. With offices in Windsor, Tecumseh, Kingsville, and Chatham, no matter where you are a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!

Source: https://www.canada.ca/en/financial-consumer-agency/services/credit-reports-score/improve-credit-score.html