The Different Types of Mortgages

As discussed one of the key steps in buying a home or property is securing your mortgage. Typically this process begins prior to the home search with getting a pre-approval. What kind of mortgage should you get though? Did you know there are different kinds of mortgages ? Let’s look at the different options you’ll have as a borrower in Canada.

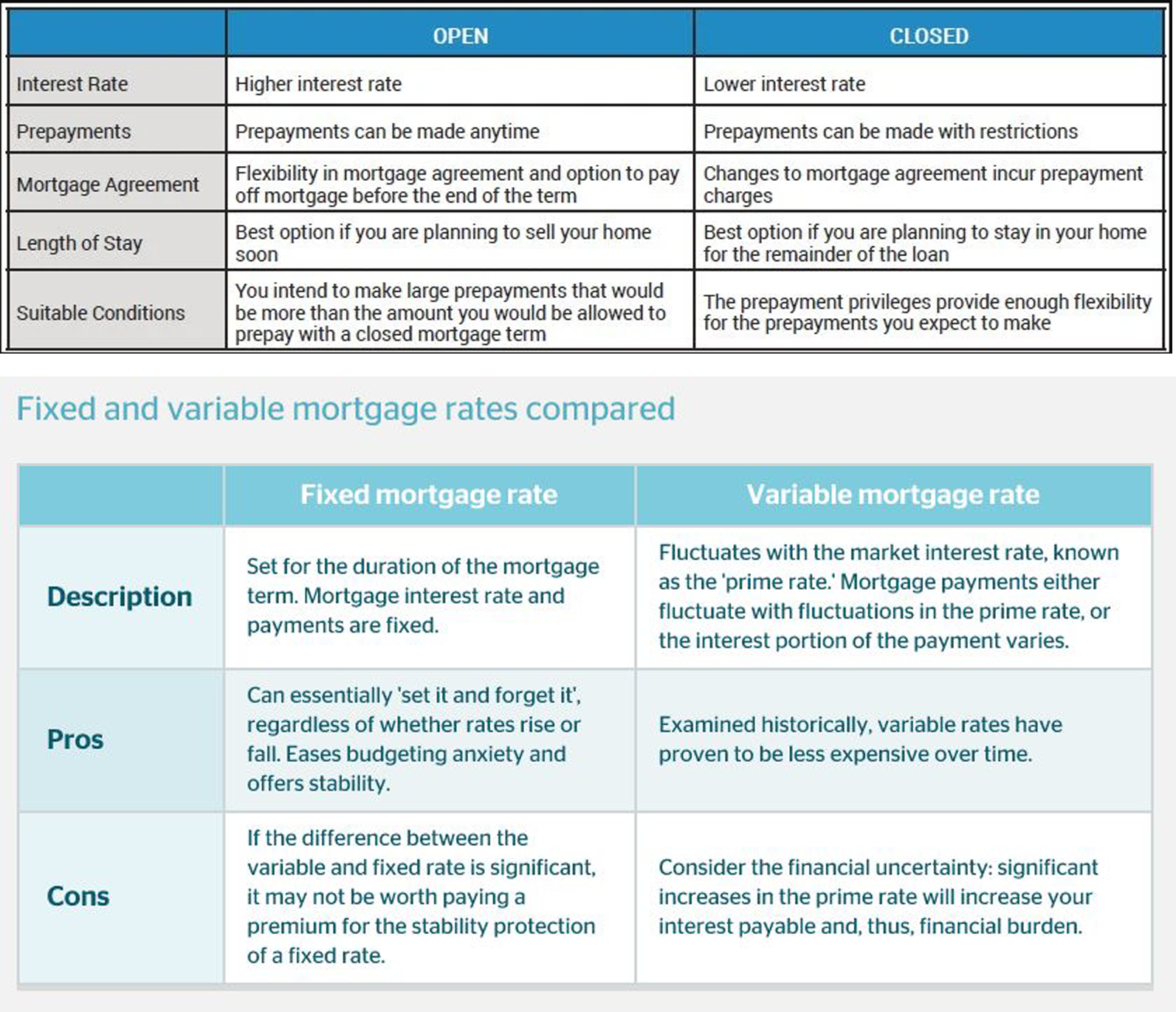

- Open Mortgage

- If you want to make large payments on your mortgage or pay off the entire mortgage without penalty, then an open mortgage is for you. Offering maximum flexibility there is the drawback of homeowners having to accept some fluctuation in the interest rate for the flexibility of paying off part or the entire mortgage before the term is complete.

- Closed Mortgage

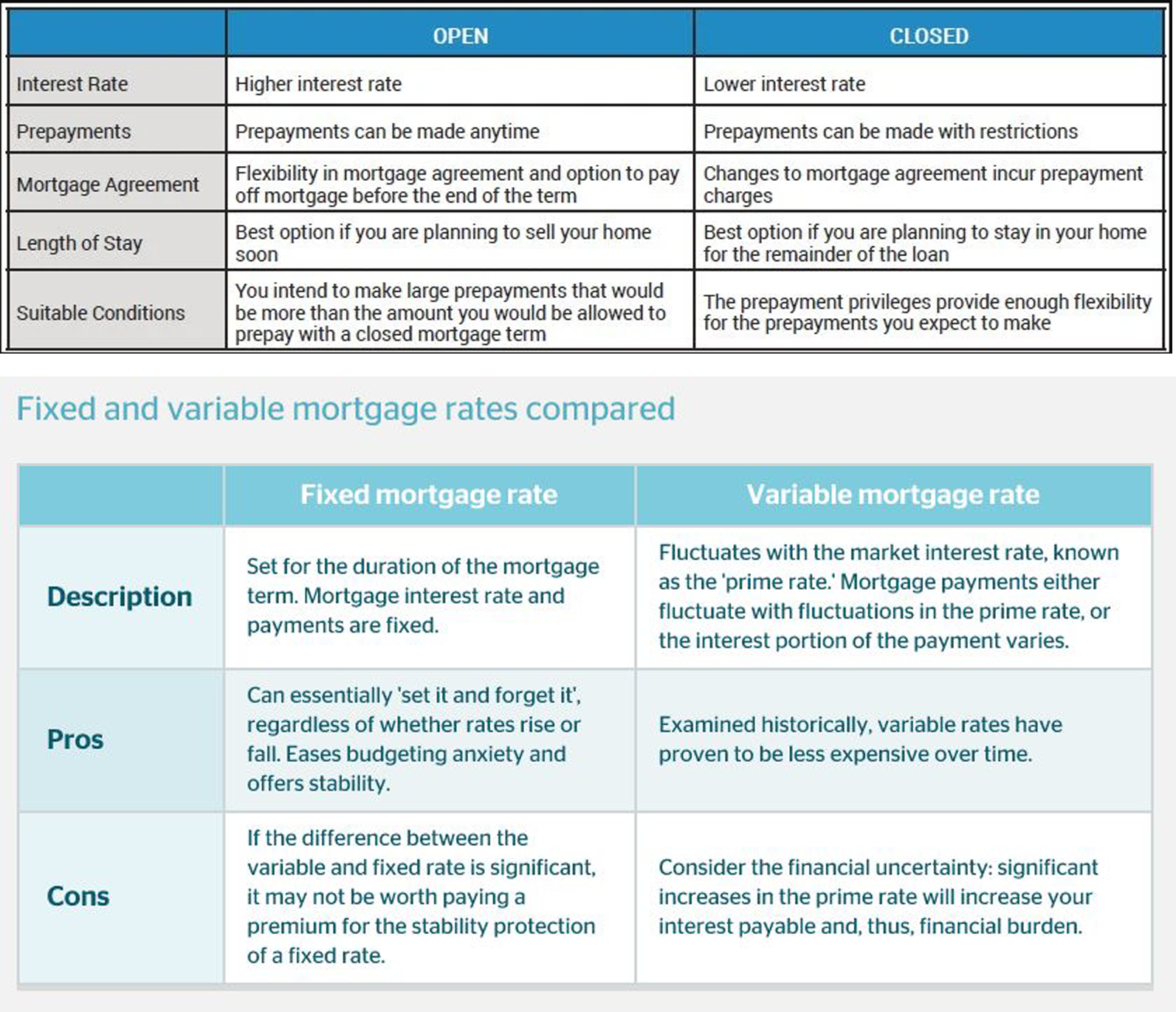

- A closed mortgage is a commitment with a pre-determined interest rate, over a predetermined period of time. Paying the loan prior to the end of the term typically results in a penalty. As the borrower, you may be able to select a fixed rate or variable (also known as adjustable) rate. They generally have lower interest rates than open mortgages. Most lenders will, however, allow borrowers with closed mortgages to make a lump sum payment of up to 10, 15 or 20% of the original mortgage amount once a year without penalty with the payment going towards the principal.

- Convertible Mortgages

- A convertible mortgage allows you to change the type of mortgage you hold during its term. You can start with an open mortgage and then lock into a closed mortgage later. It offers lower rates than an open mortgage and has the option of switching to a closed term. A conversion to a fixed rate mortgage can also be done by most lenders when you have originally selected a variable rate mortgage and now wish to move to a fixed rate before the end of the term.

- Hybrid Mortgage

- A hybrid mortgage is a term used when there is more than one type of mortgage contained in a single mortgage registration. It could include a fixed rate portion, a variable rate portion, a line of credit portion, or any combination of these. Each lender will have their own unique name for this type of mortgage. They will allow anywhere from 2 to 100 different products contained in the registration of the mortgage.

- Reverse Mortgage

- This type of mortgage allows homeowners 55 years and older to convert their home equity into either a lump sum payment or monthly cash payment(s), generally for living expenses. A homeowner’s equity is drawn down by the lender to the homeowner. When the homeowner no longer wishes to occupy the property as their principal residence, or upon their death, the loan balance is due. The balance of the loan is settled from the proceeds of the sale of the property either by the owner themselves or their heirs.

Here at Jump Realty, all of our agents put their customers' needs at the forefront of their work. They’ll give you honest advice on what course of action is best for you in their professional opinion and will always put you first! If you are thinking of buying, our REALTOR®’s can help you get in touch with mortgage and financial experts to set you on the right path. With offices in Windsor, Tecumseh, Kingsville, and Chatham, no matter where you are a Jump agent is ready to help. Please contact us for any housing needs and let us give you a better real estate experience!